Key points

- Banking is an essential public service – but in Australia it has become entirely privatised.

- A new public bank for NSW would add much-needed diversity to the banking sector.

- A public bank is run by the public, for the public, putting community needs front and centre.

- We can use it to support the community to address the big challenges of our time, like climate change, economic inequality and housing affordability.

SHOW YOUR SUPPORT NOW

BENEFITS OF THE PUBLIC BANK

Owned by us

Safeguards our future

Saves government money

Run for us

Creates jobs

Supports not-for-profit banks

Invests in our community

Provides us with security

Provides housing

BENEFITS OF THE PUBLIC BANK

Owned by us

Government-owned entity

Accountable to the public

Safeguards our future

Invests only in projects that advance community and environmental aims

Saves government money

Cuts out intermediaries, eliminates fees

Projects financed at lower interest rates

Run for us

Legally obligated to benefit NSW people

Serves local community needs

Creates jobs

Supports small businesses

Facilitates public investment

Supports not-for-profit banks

Partners with not-for-profit banks in NSW, providing them with cheaper and easier access to funding

Invests in our community

Reinvests profits back into the community

Funds community projects

Provides us with security

Lends during times of stress and crisis

Helps sustain healthy local economies

Provides housing

Assists individuals unable to afford mortgage repayments or rent to stay in their homes

BENEFITS OF THE PUBLIC BANK

Owned by us

Government-owned entity

Accountable to the public

Invests in our community

Reinvests profits back into the community

Funds community projects

Run for us

Legally obligated to benefit NSW people

Serves local community needs

Safeguards our future

Invests only in projects that advance community and environmental aims

Creates jobs

Supports small businesses

Facilitates public investment

Provides us with security

Lends during times of stress and crisis

Helps sustain healthy local economies

Saves government money

Cuts out intermediaries, eliminates fees

Projects financed at lower interest rates

Supports not-for-profit banks

Partners with not-for-profit banks in NSW, providing them with cheaper and easier access to funding

Provides housing

Assists individuals unable to afford mortgage repayments or rent to stay in their homes

Environmental destruction is driven by government obsession with economic growth, which in turn is driven largely by the financial system. Reforming the financial system is a necessary step towards creating a new sustainable economy, one in which humanity can live within its ecological bounds while improving quality of life for all.

Policy-makers are stifled in reforming a financial system in which banks are almost entirely privately owned. Creating a public bank will add much-needed diversity to the banking options available in NSW, assist in meeting immediate community needs and also help us to address the big challenges of our time, like climate change.

A public bank puts more power in the hands of the people

By democratising basic financial services and investment decisions made with our money, we can ensure that our collective wealth is used to benefit us today as well as building the future we want to see tomorrow.

Unlike Australia’s existing banks, the Public Bank of NSW will be obliged to pursue certain social and environmental outcomes. This will ensure our money is not just well-looked after, but actively contributing to a better world. This will include:

- Investing in socially-responsible investments for everyone’s benefit (eg. renewable energy infrastructure)

- Guaranteeing housing and ending homelessness

- Financing councils and community groups for local projects

- Reclaiming community resources from profit-seekers

- Supporting full employment and a just transition for coal communities

- Democratising workplaces and supporting worker-owned businesses

- Renationalising and improving public transport

- Supporting sharing and exchange programs

How would it work?

Every person in NSW will be entitled to open a fee-free deposit account with The Public Bank. This will help to streamline payments from the State government, particularly during a crisis.

The Public Bank will also help individuals in NSW with low interest rate loans. This will ensure more equitable access to funding as we rebuild the economy post-COVID, particularly for small businesses and sole operators.

The Public Bank will also partner with NSW-based not-for-profit banks and will support local government by issuing loans to local councils at low interest rates.

The Public Bank will be required to invest in only public interest projects, such as public housing and local renewable energy projects. The Public Bank will not be permitted to invest in, or do business with, harmful industries such as the fossil fuel industry or the gambling industry.

Best of all, the Public Bank will also help us finance a Universal Wellbeing Payment.

How would we do it?

Legislation to establish NSW’s public bank will require the majority of NSW’s financial assets (estimated at around $150bn), along with all cash and financial assets of Councils (conservatively estimated at $10bn), to be deposited in the Public Bank. In turn, the Bank will pay all dividends to the State of NSW, helping to ensure a healthy State budget.

As of 30 June 2021, the State of NSW had $154.7bn in cash and financial assets. In FY2020-21, the NSW Government paid $44.3m in transaction fees for banking products with Westpac, ANZ and Citi.

The Public Bank would be directly accountable to the Parliament of NSW, not to the Government, and it would have a member-elected Board with a variety of representatives, including worker, union and local council representatives. This will ensure that, no matter the government of the day, the Public Bank of NSW is run for the people.

WANT MORE INFORMATION?

THE FINANCIAL SYSTEM

Reforming our financial system is a necessary step towards creating a more democratic and sustainable economy.

The problem: money for more money

There is nothing wrong with debt or credit. Allocating money to socially useful activities will usually involve lending of some sort. However, two big problems arise when the lending is done for profit by undemocratic, private institutions.

One problem is that lenders have more of an interest in simply expanding the level of debt so they can make more profit. They become less concerned that the money is allocated to useful activities, or is allocated efficiently.

A second problem is that, as in any profit-driven sector, the lending sector will tend towards oligopoly. The concentrated power of a handful of banks gives them a licence to act with virtual immunity. Indeed, the Royal Commission laid out that the big banks have systematically stolen from the community and have since escaped any meaningful punishment.

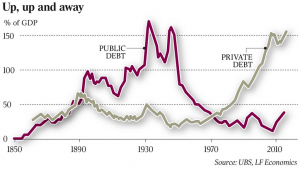

Household debt

As recently as the 1980s, Australia’s household debt to income ratio was about 60%. These days, it is closer to 200%.

Private debt, such as mortgages, has sky-rocketed to compensate for decades of austerity. This has meant massive profits for the big banks through fees and interest. The risk of debts has also been transferred away from the public as a collective, towards individuals and households.

This has played out most obviously in housing. Debt-financing private housing is the tip of the spear – shelter is a fundamental need, and a mortgage is by far the biggest debt most people will ever incur. People are practically forced to take on a huge debt and deal with that risk themselves.

The need for shelter drives the demand for debt. The need for profit drives the supply of debt. The result is a housing bubble.

Figures from the Australian Bureau of Statistics shows the average mortgage on an owner-occupied dwelling in NSW grew by 20.5% through 2021 to hit an all-time high of $779,770.

Even at today’s relatively low interest rates, it is galling that people are effectively forced to pay hundreds of thousands of dollars in interest for the privilege of owing hundreds of thousands of dollars of debt.

Given the typical dwelling price in Sydney of $1.3 million, and assuming the mortgage holder can stump up the 20% deposit, they will be paying at least $500,000 in interest over a 25-year loan.

We commonly hear that housing remains affordable because of relatively low interest rates. However, wage growth is a key factor in affordability. Looking at the size of debts and wage growth, as well as interest rates, gives a better picture of affordability. Using this measure, this graph shows housing in Australia is the most expensive it has ever been.

The twin problems of profit-driven lending and concentrated power come together in mortgages. The Big Four banks control over 80% of home loans in Australia. With that kind of power, the big banks can do pretty much whatever they want.

The big banks

The scathing Banking Royal Commission proved what we already know – the big banks will always put corporate profits first. In the ten year period to 2018, the Australian banking sector saw more than 60 scandals come to light, exposing corruption, bribery, and mishandling of customer money.

The big banks have too much power over our communities. They have too much control over our housing, over small businesses, and over what infrastructure gets built. By seeking out whatever will make them a profit, rather than what is beneficial for society, the big commercial banks can never be what we need them to be.

With quickly rising inequality and a climate crisis that demands immediate action, we can’t hope that the private sector will turn itself around.

It’s time to take that power back with our own Public Bank.

Public banking elsewhere

Public banks are run successfully all over the world. In fact, there used to be a public bank in NSW until it was corporatised and sold off. Progressive community-minded public banking is gaining traction worldwide in the aftermath of the global financial crisis.

Principles of public banking

Public banks:

- Are owned by the people of a state, city, community, or nation as a public asset

- Serve as the depository for government funds

- Are required to benefit the public by serving local community needs

- Can save state and local governments money by cutting out middlemen and private shareholders, eliminating fees, and financing projects at lower interest rates

- Reinvest bank profits into the community, providing a new source of income for cities and states and a source of funding for projects

- Are run by qualified bankers serving a public mission

- Provide accountability and transparency to the public for bank decisions, avoiding the risks of the big banks’ speculative gambling

- Create new jobs by supporting public investment and local small businesses

- Partner with and support non-profit community banks

- Can lend during times of stress and crisis, helping to sustain a healthy local economy

Adapted from the Public Banking Institute

Public and community-owned banks in Australia and overseas

Commonwealth Bank of Australia (until 1991)

- Established by the Commonwealth Bank Act 1911

- Provided essential bank services through both World Wars

- Promoted stability during the Great Depression

Current Australian non-profit banks

- 63 mutuals, cooperatives, building societies and credit unions

- Owned by their member customers

- Over one third of all deposit-taking institutions

Kiwibank (New Zealand)

- Partnered with NZ Post to provide no-frills banking

- Reduces fees across the sector

- Highest customer satisfaction of any major bank in NZ

Den Norske Bank ASA (Norway)

- Norway’s largest financial services group

- Used by almost 40% of the country

- Plans to invest NOK 580 billion for GHG emissions reduction by 2025

Sparkassen-Finanzgruppe (Germany)

- 70% share of lending to small and medium size businesses

- Controlled by democratically accountable municipalities

- Legislated social directive to ensure banking services are available to everyone

United States

- North Dakota public bank has been operating since 1919 and is the most profitable bank in the United States

- California has recently passed enabling legislation for cities and counties to create and sponsor public banks, and more recently passed an additional bill to study the feasibility of public banking

- New Jersey is currently setting up a public bank

- Philadelphia in the process of setting up a public bank (the first in US at a municipality level)

- Public banking has gained renewed attention in the United States in the last couple of years. Rashida Tlaib and AOC are rolling out a plan to help create public banks across the country

- A New Mexico Public Bank is to be considered by legislators in 2022

WANT TO GET INVOLVED?

Join our campaign for a Public Bank of NSW today, and help us ensure a future for all of us.

SHOW YOUR SUPPORT NOW

Have you seen our campaign for a Universal Wellbeing Payment? The UWP is a basic income for everyone — no means testing, no bureaucrracy, no strings attached. It means you will always have what you need to live a good life, no matter what. Help make it happen.

GET IN CONTACT

The Greens acknowledge the Traditional Owners of country throughout Australia and recognise their continuing connection to land, waters and culture. We acknowledge that these lands were stolen and sovereignty was never ceded. We pay our respects to Elders past, present and emerging.